Buying travel insurance is always a hassle. There are so many websites online, and it takes way too much effort. And do you even really need it? Even if your trip is short and you will most likely not injure yourself or have anything negative happen to you? In this article I aim to answer all these questions and more. Of course, the quick answer is yes, but I will outline why. I will also make the process easier for you to find and book the appropriate insurance for your travels.

Contents

Why travel insurance?

First of all, I have to say that traveling without an insurance plan is never a good idea, especially when you are traversing unfamiliar territory with rules and regulations that are different to what you know at home. Not only does an insurance plan help protect you against uncertain financial and health risks, but they also provide you with a peace of mind as you travel and do exciting and slightly risky things. Accidents do happen and we can’t prevent them at all times, but if you’re covered by insurance, you won’t have to pay the full cost of a loss, which can come in mounting bills. And when it comes to peace of mind – this will not be just for you, but also for your loved ones back home.

In Vietnam, accidents can be very common. It is the same for other Southeast Asian countries too, and literally anywhere else in the world. So it’s always better to be ready.

Read more: How to Win at the Game of Saigon Traffic

What do travel insurance plans cover?

From trip cancellation to adventurous motorbiking across the country, travel insurance can be picked individually and tailored to your needs. They also come as a package that would cover just about everything. Here are the main things that travel insurance should cover for your trip to Vietnam:

1) Health/Medical Insurance

The first thing to know about healthcare in Vietnam is that it falls on either end of the spectrum: very cheap and basic with substandard quality, poor equipment, overcrowding and unattentive staff; or international standards with up-to-date equipment and staff trained overseas, and of course mounting bills. When mishap occurs and your body is in tremendous pain from an accident or illness, you will want to be taken care of the best way possible, and thinking about that impending bill would add to your mental stress. That is when a travel health insurance plan comes in handy: it ensures that you have the best medical care possible all the while insuring you against a plummet in your savings.

Health insurance is imperative even if you believe yourself to have above average health. In Vietnam, just like any other Southeast Asian nation, roads are chaotic, and food safety in certain places is questionable. The weather is also ever changing, seeing as Vietnam is a long stretch of a country spanning multiple climate zones. So it is always better to be safe than sorry.

2) Trip cancellation, interruption and delay

First for some definitions: Trip cancellation is when you don’t go on your trip at all, trip interruption is when you begin a journey but have to cut it short, and trip delay means postponing your plan. Having an insurance covering alterations as such to your pre-paid, non-refundable air tickets, hotels, tour bookings, etc… is essential for those travel emergencies you can’t predict. It can either be you, your travel companion or family member back home suddenly falling ill that cancels or interrupts your trip, or simply due to bad weather causing a flight to be delayed and thus resulting in a missed connection flight, which then affect your reservation for the hotel or tour you were so looking forward to. These fees might add up to a considerable amount without insurance.

There’s a catch though: trip cancellation insurances often require you to show you made a good faith effort to continue your trip and also evidence that you’re making a claim for unexpected incidents. Factors such as pre-existing medical conditions, connecting flights less than 3 hours apart may not ensure that you’ll get your money back. What you should do to avoid this is to document your efforts as detailed as possible, such as the reason your flight was canceled, the time you spoke to airline representatives and the quote of their response.

3) Adventurous activities

If you crave for that sense of adventure that a new land has to offer an experienced traveler, Vietnam offers an array of attractive activities: hiking, trekking, abseiling, sightseeing in caves, scuba diving, cruising, etc. A specific category of insurance is needed to cover you and your travel companions in such cases, such as the Explorer Plan from World Nomads. And even if you choose to stay in the city, you will not want to miss the most authentic way to experience Vietnamese life: getting on the back of a motorbike.

Road maintenance and driving standards can be a big change to you, especially if you are coming from Europe or the States. Traffic accidents do unfortunately occur frequently, especially since motorbikes and scooters account for 95% of registered vehicles. If you want to engage in those adventurous motorbike tours, medical insurance will simply do you good. If you want to be fully covered while riding motorbikes in Vietnam, you need the following policies:

- Medical insurance: where emergency medical expenses, the cost of evacuation and repatriation is no longer on your shoulder should accidents occur;

- Third party liability insurance: where it covers damages or loss you accidentally incur to a third party;

- A valid motorcycle license: if you engage in some light riding of a vehicle of 50cc or less, no license or permit is required. To ride a motorcycle of 50cc or greater, on the other hand, Vietnamese law clearly states that you must have a Vietnamese license, and you can obtain one only if you have a visa that allows a stay of longer than 30 days. Click here for more information about the policy.

Thus, make sure you check the category of vehicle and engine size in the fine print of your insurance. Some packages only cover 100 cc’s or less while other more expensive packages will cover larger engine bikes. Moreover, no travel insurance company is obliged to cover you if you ignore usual safety precautions, such as not wearing helmet, being under influence of drugs and alcohols, engaging in competitive riding, or violating local road rules.

4) Loss and theft

While Vietnam is relatively safe for travellers, at least according to the renowned Lonely Planet, petty crimes such as bag snatching, phone grabbing, pickpockets, con artists, etc… occur to the occasional misfortunate traveler. Travelers have the advantage of taking a further step in safeguarding against such loss once one purchases an insurance.

It is advisable that you keep the receipt of your belongings and ask for a police report should your things get lost or stolen. Most insurance packages require official reports for claiming stolen or lost property.

5) Comprehensive/package plan:

You can save your sweats by purchasing all the above-mentioned insurance plans as a package, also called a comprehensive plan, This is a great idea, especially when you’re new to this whole confusing insurance thing. These packages can vary per plan, though, so always make sure to study the fine print nevertheless.

How often should I buy travel insurance?

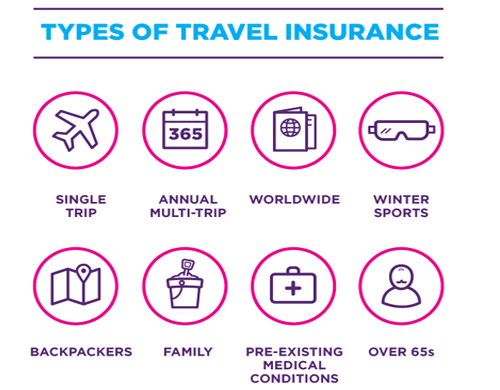

You can purchase travel insurance every time you go on a trip, or you can opt for an annual multi-trip travel insurance, which usually covers any number of trips within a period of time, usually a year. If you are a regular traveler, or you are planning a long haul adventure, an annual insurance may work out cheaper.

It can also be the case that levels of cover, particularly for medical expenses, baggage and cancellation tend to be more generous on an annual policy. If you are a frequent traveler, it takes the hassle out of organizing insurance for every trip you take.

How to pick the right travel insurance plan?

First of all, reflect on your vision for the trip, decide on activities you think having insurance would be a good idea for. Or if you’re unsure, opt for comprehensive plan.

Always read your policy documents carefully so you understand your coverage. You can easily search for insurances online, study the quote and fine print, and especially pay attention to:

- What is included and excluded in the policy

- How to contact your insurer when you are overseas

- What paperwork or information you need to take with you

- The monetary limits for claims on individual items and as a whole

- The proof you might need to make a claim

- 24/7 hotline assistance with free call number from overseas. Accidents don’t have regular office hours, so your insurance shouldn’t either.

-

- Compare the insurances. Insurance provider comparing sites:

- Squaremouth: This site helps you to compare 107 travel insurance policies from 22 providers with more than 45,000 reviews.

- Insure My Trip: There is an extremely useful online insurance marketplace called Insure My Trip. Most major travel insurance companies are here, and you can compare them and their policies side by side. You can also filter searches based on important factors such as customer feedback and more.

- gobear: This is an online review community. Before you make any purchase online, you can go to this site to see what other people have to say about the company or service. Then you will have the information you need to make the best purchase.

- Compare the insurances. Insurance provider comparing sites:

-

- Contact insurance provider to double check their policy details before making a purchase. Clarify things you’re unsure of and finally, make a decision.

Where can you buy a good travel insurance plan?

Now that you know travel insurance is a good investment before any trip, you’ll be wondering which companies provide good plans..

Though some banks (like ICIC, Royal Bank, and HSBC) and travel companies also offer travel insurance, the most common way that many people often buy insurance is through websites of prestigious and reputable companies. They always offer many different plans for different budget levels and travel styles/dates. So you can easily choose the one most suitable to you. Some good reputable insurance companies which my friends and I usually use are: IM Global, AIA, World Nomad, AXA, Liberty Travel Insurance, etc..,

Travel companies also offer insurance but I would say it is not a good idea. Because they might hunt for a company that pay them the highest sale commissions instead of the one that’s really best for you.

By the way, try not to opt for the cheapest travel insurance option. Many of them do not offer what you will need. Always compare and make sure you study the plan well!

How to buy a travel insurance plan?

The purchasing process is different from each company, but generally, it will go through these steps:

1. Access the site of the insurance company

You will need to make up your mind about which company has a good and sustainable plan for your trip. Then follow through to their website.

2. Choose your trip coverage

The 2 types of trip coverages are:

Single coverage: This is a coverage for a single trip. It is perfect for occasional travellers

Annual coverage: This is a whole year plan. It is suitable for those who go travel frequently (either for business or personal purposes).

3. Fill in the form

The system will ask you for some demographic information such as name, age, gender, ID number, some important dates (requested coverage effective date, departure date, return date and so on), contact information (address, phone number, email).

4. Choose your plan

Before or after you submit the form, the system will process the information. They will then send you a quotation according to their calculations. Now is the time to choose a suitable plan for your budget.

5. Review your information

It is important to check the information you provided on the form. Make sure that everything is correct.

6. Choose your payment

Fill out your payment information – payment type, card holder’s information and billing address. Don’t forget to sign your name if requested.

7. Complete the purchase

After submitting the payment form, you should receive a confirmation email. Check your inbox and follow the instructions then.

KEEP IN MIND

Although you can buy the insurance whenever you can (even one day before your departure), I suggest you should purchase it at least a week in advance. Because due to the policy of each company, your insurance can either be verified immediately after your payment or the verification process might require 2 – 5 days.

Note: Sometimes, it is even essential to obtain an insurance plan BEFORE you apply for a visa for certain countries. Of course not all passports require acquiring visa in advance, but it is best to check online.

Here’s an all-you-need-to-know about Vietnam Visa guide.

What else?

Copy your insurance plan and give it to one or two trusted people back home who can provide the information in case you lose yours or are unable to provide it, for instance your bag got lost or unfortunately you become unconscious after an accident.

It is also advisable to keep your insurer and emergency contact details somewhere they can be easily found, such as your wallet.

Make sure you have a list of stuff you are taking on your holiday, including any receipts if possible. Keep your hospital bills, flight ticket invoice, police reports for loss and theft, etc, as well. That will make any claims considerably easier.

Conclusion

- pre-cautions first

- may be avoided through preemptive action

- unexpected circumstances that you’re insuring against

- need to cancel or cut your trip short because your dad died. It’s designed to be there for accidents (both health and non-health related) and unexpected events you never thought could happen to you

Be safe and happy travelling!

PS: Flying in to Ho Chi Minh? Click here for a step by step process and a full airport guide: Arrivals Guide to the Ho Chi Minh Airport

Enjoyed this article and want more fun information on what to do, see and eat in Vietnam? Follow us at the 4U Trip!